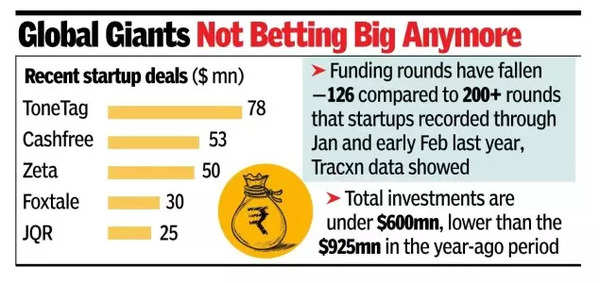

MUMBAI: With large deals hard to come by, Indian startup funding is being led by small and mid-sized cheques. On Tuesday, Fintech unicorn Zeta said that it has raised a fresh $50 million from American healthcare firm Optum at a valuation of $2 billion, higher than its last valuation of $1.2 billion while a bunch of investors infused $78 million in a mix of primary and secondary capital into ToneTag, a Bengaluru startup offering payment solutions.

Deals in the range of $20-30 million have gathered pace, thanks to an expanding pool of domestic investors who are increasingly co-investing in funding rounds but the overall pace of investments have been muted so far. “Capital is chasing stable businesses that can generate profits,” Bhavin Turakhia, co-founder and global CEO at Zeta told TOI.

Funding rounds so far have been lower – 126 compared to over 200 rounds that startups recorded through Jan and early Feb last year, data sourced from market research firm Tracxn showed. Total investments stand at under $600 million, lower than the $925 million that companies had garnered by this time last year. “The bulk of the deals would continue to be in the early to mid-stages ($20-30 million). The pace of deals in the range of $50-100 million would also be slower. There are investors but a lot more cautious investors. There will obviously be some outliers like quick commerce and AI sectors which are going through a hype cycle and will see large deals,” said Nishit Garg, partner, Asia Investment Team at venture capital firm RTP Global.

Big investors like SoftBank and Tiger Global have not been making very large India bets for about a couple of years now, explaining the drop in large deals. SoftBank, for instance, has largely been participating in follow-on investments in existing portfolio startups cutting cheques in the range of $25-60 million while most recently, Tiger Global backed Infra.Market in a $121-million pre-IPO funding round alongside other investors. Following the funding frenzy of 2020 and 2021, some investors became inactive, said analysts. “We need later stage domestic VC funds who can help complete the funding life cycle of a startup. Until now, the big rounds have come from large international funds who aren’t as active anymore. This creates a gap in funding,” said Archana Jahagirdar, founder and managing partner at Rukam Capital.