Interest rates have been held at 4.5 per cent by the Bank of England (BoE) amid mounting global uncertainty and growing trade tensions sparked by Donald Trump.

That was the level reached in February when the Monetary Policy Committee (MPC) made its first cut since November last year, in so doing bringing the rate down to its lowest level since mid-2023. March’s decision saw the MPC members vote 8-1 in favour of maintaining the 4.5 per cent rate – with one vote for another 0.25 percentage points cut.

While the interest rate is still expected to fall further over the remainder of the year, only two further cuts are now expected across 2025 amid an ongoing battle with inflation, rising costs for businesses and an uncertain wider economic outlook.

A significant portion of that uncertainty is due to Donald Trump’s trade tariffs being placed – and altered or withdrawn at short notice – which has created unrest in industries and could see the cost of selling their goods to the United States rise significantly. While the UK has yet to implement any retaliatory tariffs, an escalating trade war could significantly hit economic growth as well as consumers’ spending power.

The UK interest rate remains above the eurozone rate, which the European Central Bank cut to 2.5 per cent earlier this month, while on Wednesday, America’s Federal Reserve opted to pause its own cuts, leaving borrowing rates at 4.25-4.5 per cent.

The BoE utilises the interest rate as one of the ways to attempt to control inflation, with a target rate of two per cent.

Inflation’s impact

When the BoE made the Bank Rate cut last month, inflation had been on the decline. However, a mid-February report showed Consumer Prices Index (CPI) inflation rose to 3 per cent in January, from 2.5 per cent in December.

With inflation therefore rising again – and, importantly, rising by more than expected – interest rates were always unlikely to be cut this time around.

Lower interest rates can be used to encourage businesses to resume investing as the cost of borrowing is lower, which can give the wider economy a boost.

However, it can also lead to rising prices as investment in more jobs or salaries mean people have, and spend, more money; therefore the reverse is also seen as true in that if demand is lower, it can help reduce these potential price rises – or in other words, it can help stem inflation.

The BoE have stated they’ll take a cautious approach to reducing the interest rate so as not to see a sharp spike in inflation, as was seen a couple of years ago.

Mortgages, savings and businesses

Interest rates are a double-edged sword for households.

On the one hand, the higher it is, the better it is for those with money in savings accounts as they earn a higher return on their cash.

Opposite side of the see-saw to savers sits homeowners. Mortgages can naturally become more expensive when interest repayments have to go up based on an increasing interest rate.

Fixed-term deals negate the need to be concerned over changes, but after a rapid increase in costs over the past two years many homeowners would have been hoping for bigger cuts this time around.

“While the Central Bank has avoided adding fuel to the fire, the government must now take decisive action. Simply waiting for interest rates to cool inflation is not a plan. Savers need consistency and support to restore confidence in their financial future,” said Lily Megson, Policy Director at My Pension Expert.

“With the Chancellor’s Spring Statement fast approaching, we can only hope for a renewed focus on ensuring people can save enough for a secure financial future.”

David Hollingworth, associate director at L&C Mortgages, noted that as the hold had been expected, it should cause “barely a ripple in the mortgage market” this time around.

For businesses, while no change to interest rates means short-term continuity in terms of borrowing costs, the looming Spring Statement next week is a bigger factor ahead of increased labour costs coming into play – especially set against the backdrop of trade tariffs.

“Tariffs mean prices and costs will inevitably go up and this is a lose-lose scenario for consumers, businesses, and economic growth. More tariffs are also on the agenda for the start of next month which will add fresh uncertainty into the mix,” said William Bain, British Chambers of Commerce (BCC) head of trade policy last week.

Outlook for 2025

Most analysts are still expecting two further rates cuts in 2025, which outside of mortgages and savings accounts can still affect everything from your weekly shop to energy bills.

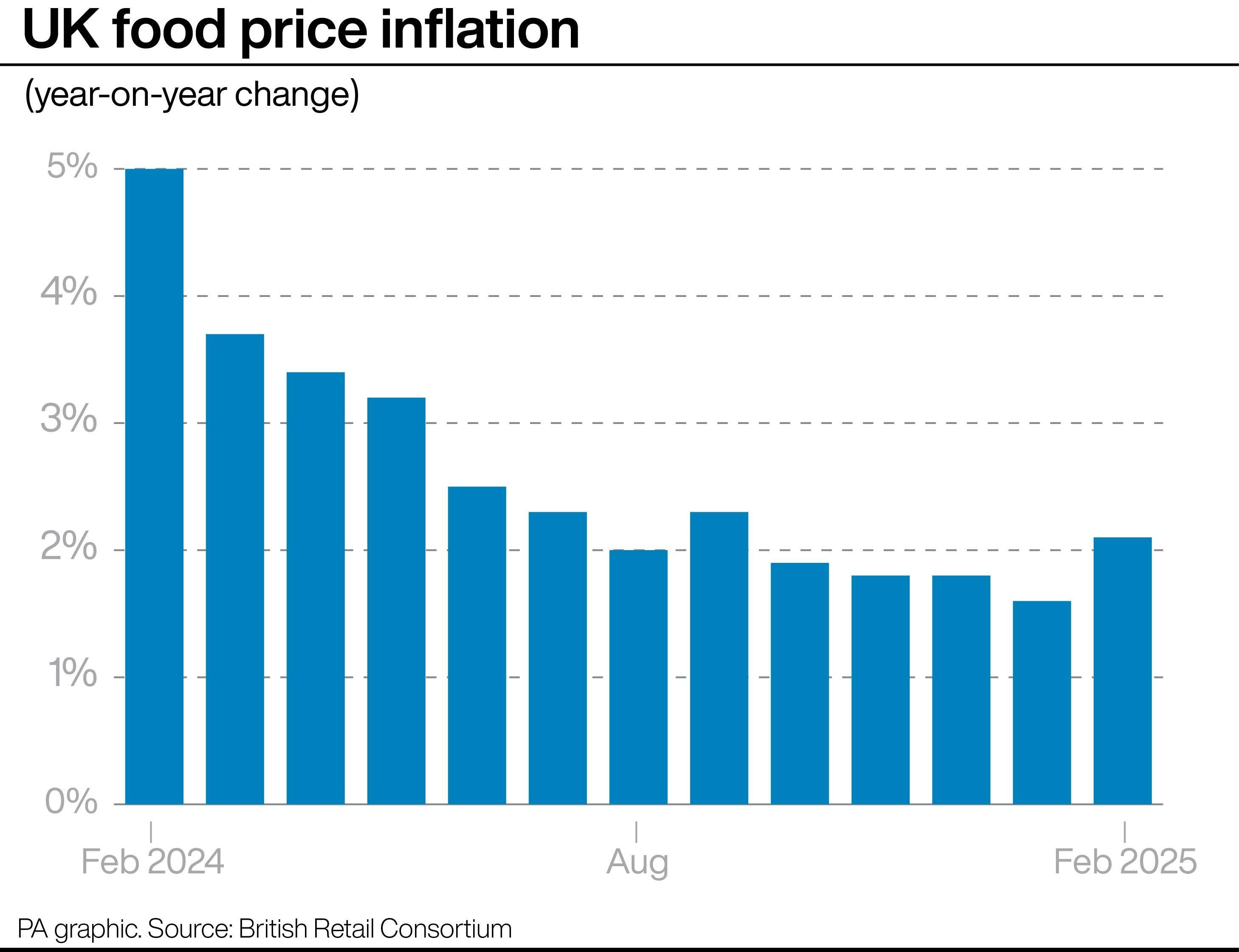

While the target is to lower inflation to two per cent, it’s rarely a straight line trajectory and the advice is to expect a bumpy ride, particularly in terms of food cost inflation later in 2025, which is expected to rise.

“It has been a turbulent few weeks, both economically and politically, so a cautious approach seems justified while the data remains so uncertain,” said Plum CEO Victor Trokoudes in reaction to the rates hold.

“The BoE has much to consider. Inflation is now forecast to increase further to 3.7 per cent due to higher energy costs and regulated prices. Gas and electric, water and broadband costs as well as council tax are all due to significantly rise in April, which adds inflationary pressure as well as generally damaging people’s day-to-day finances. These inflationary worries should likely ease somewhat later in the year, but until then the BoE will need to remain vigilant to rising prices.

“Added into the mix are political factors. Extra public spending is required on defence due to recent global developments, and employment tax increases are coming into effect shortly as well. And that’s before you take into account the looming threat of increased tariffs under the new Trump administration in the USA, though there are hopes that the UK’s trade balance with the USA puts it in a better position than others to avoid a heavy impact here.”

It also remains to be seen how those incoming additional business costs in April translate to businesses and people’s pockets, so while a lowering interest rate across the year is expected, it’s very much wait-and-see territory as to when that will happen – though economists at The Pantheon say it could be May and November this year.

It remains tricky however, if you’re looking to remortgage, move your money or otherwise manage your finances, to know when the exact best moment to do so will be, with Rachel Reeves’ Spring Statement next week the next big date to mark in the calendar for new information.