Last Updated:

The Budget 2026-27 also seeks to rationalise TDS/TCS provisions to alleviate compliance challenges and other relevant changes.

Check a brief overview of these changes and their potential impact on individual taxpayers and businesses.

The Union Budget 2025, presented on February 1, 2025, introduced substantial reforms to the personal income tax framework, focusing on simplifying tax laws, improving efficiency, and increasing the disposable income of the middle class. The Budget also seeks to rationalise TDS/TCS provisions to alleviate compliance challenges and other relevant changes.

Here’s a brief overview of these changes and their potential impact on individual taxpayers and businesses.

Proposed Changes in the Personal Tax Framework

Some of the key changes proposed in the Personal Tax Framework include:

Revised Tax Structure Under the New Tax Regime

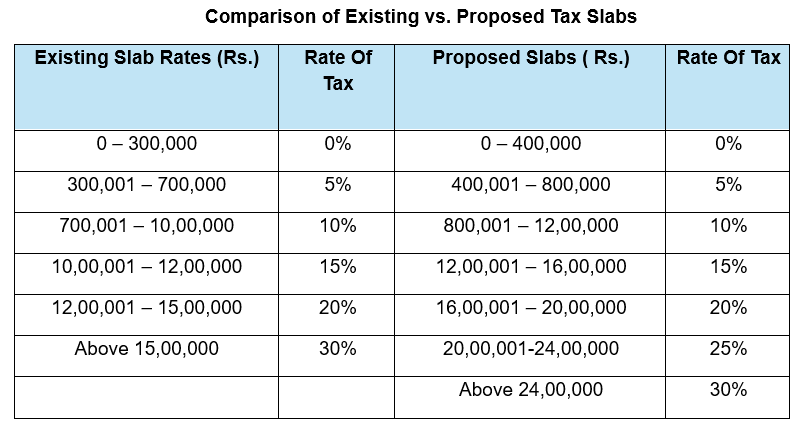

Budget 2025 has proposed revisions to the income tax slabs under the new tax regime, making it more attractive for taxpayers opting for this framework. The updated structure introduces reduced tax rates, particularly benefiting middle-class taxpayers, with the objective of simplifying taxation and enhancing compliance. By minimising exemptions and deductions while maintaining lower tax rates, the government aims to streamline the tax system.

The proposed changes aim to provide greater tax relief by increasing the basic exemption limit to Rs. 4,00,000 and expanding income slabs with lower tax rates, encouraging wider adoption of the new tax regime.

Enhancement of Rebate Limit Under Section 87A

The Government has significantly enhanced the rebate under Section 87A for the new tax regime, extending tax relief to a larger segment of taxpayers. Under the existing structure, individuals with taxable income up to Rs. 7 lakh were eligible for a full rebate, ensuring that they paid zero tax. With the latest amendment, this threshold has been raised to Rs. 12 lakh, meaning individuals with net total income upto Rs. 12 lakh annually will now pay no income tax after availing the rebate.

Further, Budget 2025 explicitly states that income taxed at special rates (such as capital gains under Sections 111A, 112, etc.) shall be excluded when computing the income tax rebate under the first proviso to Section 87A in the new tax regime.

This increase in the rebate limit from Rs. 25,000 to Rs. 60,000 is expected to provide substantial relief to salaried individuals and middle-class taxpayers, effectively enhancing their disposable income.

Extension in Timeline for filing Updated Returns u/s 139(8A)

Section 139(8A) of the Income Tax Act, 1961 (hereinafter referred to as ‘the IT Act’) allows taxpayers to file an updated return to voluntarily disclose omitted or underreported income. Currently, such return can be furnished within 24 months from the end of the relevant Assessment Year (AY), subject to payment of an additional tax of:

- 25% of the total tax and interest payable if filed within 12 months from the end of the relevant AY.

- 50% of the total tax and interest payable if filed between 12 to 24 months from the end of the relevant AY.

To further encourage voluntary compliance, Budget 2025 proposed to extend the time limit to 48 months from the end of the relevant assessment year, with the following revised penalty structure:

Extension of Deduction Benefits u/s 80CCD to contributions made to NPS Vatsalya

The benefits under Section 80CCD, which were previously limited to individual NPS accounts, have now been expanded to include contributions made to NPS Vatsalya Accounts. This change provides tax savings for parents who are investing in their children’s future through the National Pension System.

- Tax Deduction for Contributions: Parents/guardians can claim a deduction up to Rs. 50,000 per year u/s 80CCD(1B) for deposits made in the minor’s NPS Vatsalya account.

- Taxation on Withdrawal: Amounts for which deductions have been claimed, along with accrued income, will be taxable at the time of withdrawal when the minor accesses the funds.

- Exemption in Case of Minor’s Death: If the account is closed due to the minor’s death, the received amount will not be considered taxable income for the parent/guardian.

Additionally, the scheme permits partial withdrawals for specific contingencies such as education, medical treatment for serious illnesses, or disability (above 75%). To facilitate this, a new clause (12BA) in Section 10 is proposed, exempting partial withdrawals up to 25% of contributions from the guardian’s taxable income, provided they comply with PFRDA regulations.

Clarity on Taxation of Unit Linked Insurance Policy (ULIP) Redemption

Section 10(10D) of the IT Act provides tax exemption on sums received from life insurance policies, subject to the condition that the annual premium does not exceed 10% of the capital sum assured. To restrict this exemption to genuine life insurance cases, the Finance Act, 2021, introduced a limit, denying exemption to ULIPs issued on or after February 1, 2021, if the annual premium exceeds Rs 2,50,000.

Currently, ULIPs that do not qualify for this exemption are treated as capital assets, and their redemption is taxed as capital gains, while non-ULIP life insurance policies (not eligible for exemption) are taxed under “Income from Other Sources”. To streamline the taxation, the Budget 2025 proposes to:

- Clarify that ULIPs not eligible for exemption remain capital assets (Section 2(14))

- Tax gains from their redemption as capital gains (Section 45(1B))

- Include such ULIPs under the definition of an “equity-oriented fund” (Section 112A)

Tax Exemption on Withdrawals from National Savings Scheme (NSS)

Section 80CCA of the IT Act allows deductions for deposits made in NSS, but no deductions have been permitted for contributions made on or after April 1, 1992. Under Section 80CCA(2), withdrawals—including accrued interest—are considered taxable income, applicable only to deposits made before FY 1991-92, for which deductions were previously claimed. Additionally, as per Circular No. 532 (dated March 17, 1989), withdrawals due to the death of the depositor were already exempt from taxation in the hands of legal heirs.

With regards to this, the Budget 2025 proposes an amendment to Section 80CCA, granting tax exemption on withdrawals (including accrued interest) made on or after August 29, 2024, for deposits made before April 1, 1992, where deductions were previously claimed. This amendment will be implemented retrospectively from August 29, 2024.

Simplification of Annual Value Determination for Self-Occupied Properties

Section 23 of the Income Tax Act governs the determination of annual value for house property. Sub-section (2) currently provides that if a house property is occupied by the owner for personal residence, or if the owner cannot occupy it due to employment, business, or profession at another location, the annual value of the property is considered nil. Additionally, Sub-section (4) restricts this benefit to only two self-occupied properties specified by the owner.

To simplify these provisions, Budget 2025 proposed to amend Sub-section (2) to allow the annual value of a house property (or part of it) to be considered nil if the owner occupies it for personal use or is unable to occupy it due to any reason. The restriction in Sub-section (4) that applies the benefit to only two properties will remain unchanged.

Proposed Changes in the Withholding Tax (TDS/ TCS) Framework

Removal of higher TDS/TCS for non-filers of return of income

Removal of higher TDS/TCS for non-filers of return of income Section 206AB and 206CCA of the IT Act provides for higher rate of TDS/TCS for specified persons who are non-filers of income-tax returns for the previous year immediately preceding the financial year in which tax is to be deducted/collected.

In order to eliminate the hardship faced by the deductor/collector to verify the filing of returns and to reduce compliance burden, it is proposed to eliminate section 206AB and section 206CCA of the IT Act.

Changes in the TDS/ TCS Rates

The Finance Minister via Budget 2025 proposed increasing the thresholds for Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) as well as rationalised the rates.

| Section | Nature of Transaction | Existing Provisions | Proposed Provisions |

|---|---|---|---|

| 193 | Interest on debenture by Public Co to Individual / HUF, Interest on other securities | Threshold: Rs. 5,000 p.a.Rate: Nil | Threshold: Rs. 10,000 p.a.Rate: 10% |

| 194 | Dividend | Threshold: Rs. 5,000 p.a.Rate: 10% | Threshold: Rs. 10,000 p.a.Rate: 10% |

| 194A | Interest other than interest on securities• for senior citizen / for others (when payer is bank or cooperative society or post office)• in all other cases | Threshold: Rs. 50,000 p.a. / Rs. 40,000 p.a.Rate: 10% | Threshold: Rs. 1,00,000 p.a. / Rs. 50,000 p.a.Rate: 10% |

| 194B / BB | Winning from lottery or crossword puzzle, etc. or Horse race | Threshold: Rs. 10,000 p.a.Rate: 30% | Threshold: Rs. 10,000 per transactionRate: 30% |

| 194D / G / H | Insurance Commission / Commission, etc. on sale of lottery tickets / Commission or Brokerage | Threshold: Rs. 15,000 p.a.Rate: 5% / 2% | Threshold: Rs. 20,000 p.a.Rate: 2% |

| 194-I | Rent | Threshold: Rs. 2,40,000 p.a.Rate: 2% / 10% | Threshold: Rs. 50,000 p.m.Rate: 2% / 10% |

| 194J | Fees for professional / technical services / royalty / amount under section 28(va) | Threshold: Rs. 30,000 p.a.Rate: 10% / 2% | Threshold: Rs. 50,000 p.a.Rate: 10% / 2% |

| 194K | Income from units of mutual fund / specified company / undertaking | Threshold: Rs. 5,000 p.a.Rate: 10% | Threshold: Rs. 10,000 p.a.Rate: 10% |

| 194LA | Enhanced compensation on acquisition of certain immovable property (other than agricultural land) | Threshold: Rs. 2,50,000 p.a.Rate: 10% | Threshold: Rs. 5,00,000 p.a.Rate: 10% |

| 194LBC | Income in respect of investment in securitization trust (Residents) | Threshold: No ThresholdRate: 30% / 25% | Threshold: No ThresholdRate: 10% |